What is Quidco?

Quidco stands as one of the leading cashback platforms in the United Kingdom, helping millions of shoppers earn money back on their everyday purchases. The platform partners with thousands of retailers, allowing users to receive a percentage of their spending returned to them as cash rewards. Whether shopping for groceries, booking holidays, or comparing insurance quotes, this service transforms regular purchases into opportunities to save money.

Brief History and Background

Founded in 2005, the platform emerged during the early days of affiliate marketing when online shopping was beginning to gain mainstream traction. The founders recognized an opportunity to share advertising commissions directly with consumers rather than keeping all profits. Over nearly two decades, the service has evolved from a simple cashback website into a comprehensive money-saving ecosystem that includes mobile applications, browser extensions, and in-store capabilities.

Market Position in the UK Cashback Industry

Within the competitive cashback industry, Quidco UK maintains a strong position as one of the top two platforms alongside its main competitor. The service boasts millions of active members who collectively earn substantial amounts annually. Its reputation for reliability, extensive merchant partnerships, and innovative features has helped establish it as a trusted name in the consumer savings sector.

Core Value Proposition

The fundamental promise is straightforward: users earn money simply by shopping as they normally would, but through the platform’s links and tools. Unlike traditional discount codes that reduce the initial purchase price, cashback returns money after the transaction completes. This means shoppers can often combine promotional offers with cashback rewards, maximizing their overall savings. The service costs nothing to use at the basic level, making it accessible to anyone looking to stretch their budget further.

How Quidco Works

The Cashback Mechanism Explained

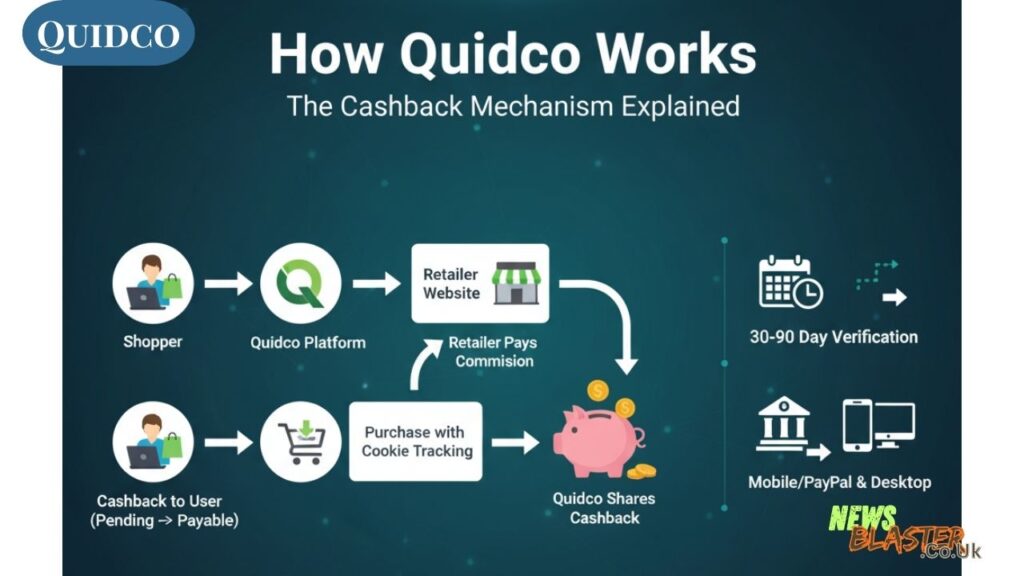

The cashback process operates through affiliate marketing partnerships. When users click through the platform to make purchases, retailers pay a commission for directing business their way. Rather than keeping this entire commission, the platform shares the majority with users as cashback. The percentage varies depending on the retailer and product category, ranging from less than one percent to over ten percent on certain purchases.

Merchant Partnerships and Affiliate Marketing Model

The platform has established relationships with thousands of retailers across virtually every shopping category imaginable. These partnerships benefit all parties: retailers gain customers, the platform earns referral fees, and shoppers receive cashback. Major brands participate because they recognize the value of reaching engaged consumers who are actively ready to make purchases. The affiliate marketing model creates a sustainable business structure that has proven successful for nearly two decades.

Cookie Tracking and Transaction Verification

When users click through to a retailer, the system places a tracking cookie in their browser. This cookie identifies the transaction as originating from the platform, ensuring proper credit for the purchase. After completing the transaction, retailers report the sale back to the system, which then credits the user’s account. This verification process typically takes several days to weeks, depending on the retailer’s reporting schedule and return period policies.

Payment Process and Timelines

Cashback doesn’t appear instantly in users’ accounts. Initially, rewards show as “pending” while retailers verify the transaction and ensure no returns occur. This pending period varies by merchant but commonly ranges from 30 to 90 days. Once confirmed, the cashback becomes “payable” and users can transfer it to their bank accounts or PayPal. Minimum withdrawal amounts apply, encouraging users to accumulate rewards before cashing out.

Mobile App vs Desktop Experience

The service offers both mobile applications and a desktop website, each with distinct advantages. The mobile apps for iOS and Android provide convenient access while shopping in physical stores or browsing on the go. Desktop users benefit from browser extensions that automatically alert them to available cashback opportunities while browsing retailer websites. Both platforms sync seamlessly, ensuring consistent tracking regardless of how users choose to shop.

Getting Started with Quidco

Creating an Account

Getting started requires just a few minutes. Prospective users visit the website or download the mobile application to begin the registration process. The quidco login system requires basic information including an email address and password. After email verification, new members can immediately start earning on their purchases. The sign in quidco process remains straightforward, allowing quick access whenever users want to shop.

Account Types: Free vs Premium Membership

The platform offers two membership tiers to accommodate different shopping habits and preferences. The free basic membership provides access to all retailers and features without any subscription cost. However, it includes a small annual fee deducted from earned cashback once users accumulate enough rewards. Premium membership eliminates this fee entirely for an upfront annual subscription, making it worthwhile for frequent shoppers who earn substantial amounts throughout the year.

Setting Up Payment Methods

Before withdrawing earned rewards, users must configure their preferred payment method. The platform supports bank transfers and PayPal payments, giving flexibility in how members receive their money. Setting up these payment details early ensures a smooth withdrawal process when cashback becomes payable. The system securely stores payment information, requiring verification steps to protect user accounts from unauthorized access.

Browser Extensions and Tools

Browser extensions represent one of the most valuable tools for maximizing earnings. Once installed, these extensions automatically detect when users visit participating retailers and display notifications about available cashback rates. This eliminates the need to remember to visit the platform before every purchase. The extensions work across popular browsers and provide one-click activation to ensure proper tracking without disrupting the shopping experience.

Mobile App Setup

The mobile applications extend the platform’s functionality beyond desktop shopping. After downloading from the App Store or Google Play, users sign in quidco with their existing credentials to access their account. The apps include features specifically designed for mobile shopping, such as in-store cashback through receipt scanning technology. Push notifications alert users to special increased cashback rates and limited-time offers, helping them never miss opportunities to earn more.

Using Quidco Effectively

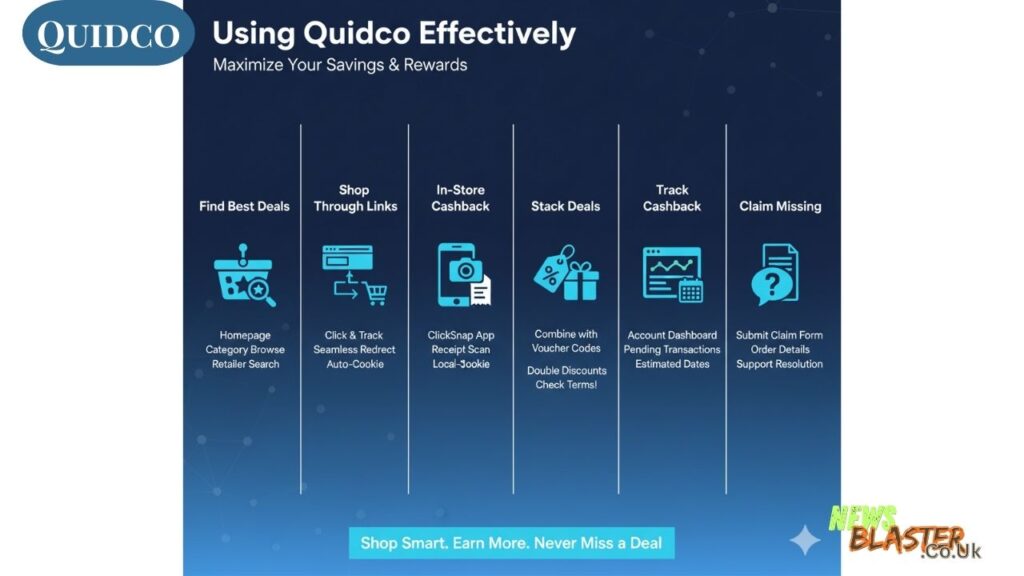

Finding the Best Cashback Deals

The platform organizes cashback opportunities in multiple ways to help users discover the best rates. The homepage features highlighted deals with temporarily increased percentages, often during promotional periods or holidays. Category browsing allows users to explore specific shopping areas like fashion, electronics, or home goods. A search function helps locate specific retailers quickly. Many users make it a habit to check the platform before any online purchase to see if cashback is available.

Shopping Through Quidco Links

To earn cashback, users must click through the platform’s links before making purchases. This critical step activates the tracking that credits transactions to user accounts. After clicking the link, a new browser tab opens directing users to the retailer’s website. From there, shopping proceeds normally—users add items to carts, checkout, and complete payment just as they would shopping directly. The only difference is the tracking cookie working in the background to record the transaction.

In-Store Cashback with ClickSnap

Beyond online shopping, the mobile app enables earning on in-store purchases at select retailers through ClickSnap technology. Users activate an offer before shopping, make purchases as usual, then photograph their receipts through the app. The system processes receipt images to verify qualifying purchases and credits appropriate cashback amounts. This feature bridges the gap between online and offline shopping, expanding earning opportunities beyond digital transactions.

Stacking Deals with Voucher Codes

Savvy shoppers maximize savings by combining cashback with other promotional offers. Many retailer pages on the platform display available discount codes and voucher codes alongside cashback rates. Users can typically apply these codes during checkout while still receiving cashback on their purchase. This stacking ability means getting both an immediate discount and earning money back later. However, users should verify that specific codes don’t invalidate cashback tracking, as some promotional codes from outside sources may interfere with affiliate tracking.

Tracking Pending Cashback

After making purchases, users can monitor their earnings through the account dashboard. The quidco cashback tracking system displays all pending transactions with details about purchase amounts, expected cashback, and estimated confirmation dates. This transparency helps users keep track of what they’ve earned and when it should become available. If expected cashback doesn’t appear within a reasonable timeframe, users can investigate potential tracking issues before too much time passes.

Claiming Missing Cashback

Occasionally, transactions fail to track properly despite users following correct procedures. When this happens, the platform provides a missing cashback claims process. Users submit claim forms with purchase details, order confirmations, and other relevant information. The support team investigates with the retailer to verify the transaction and manually credit accounts when appropriate. Filing claims promptly improves the likelihood of successful resolution, as retailers maintain transaction records for limited periods.

Quidco Features and Services

Cashback Rates Across Different Categories

Cashback percentages vary significantly depending on product categories and individual retailers. Fashion and electronics typically offer moderate rates around two to five percent, while financial services and insurance products often provide much higher amounts due to larger commission structures. Travel bookings, broadband switches, and energy comparisons may yield substantial cashback rewards. Understanding these category differences helps users prioritize where to focus their purchasing decisions for maximum returns.

Top Retailers and Merchants

The platform partners with household names across virtually every shopping sector. Major supermarkets, popular fashion brands, leading electronics retailers, and well-known travel booking sites all participate. This extensive network means users rarely need to sacrifice their preferred shopping destinations to earn cashback. New retailers join regularly, expanding the already comprehensive selection of merchants where users can earn while they spend.

Quidco Compare: Utilities and Services

Beyond retail shopping, the platform operates comparison services for utilities and recurring bills. Users can compare broadband providers, energy suppliers, insurance policies, and other services while earning cashback for switching. These comparison tools often generate particularly high cashback amounts because these industries pay substantial commissions for customer acquisition. Switching services through the platform can result in both cost savings on bills and significant cashback rewards.

Insurance Comparison

Insurance represents one of the most lucrative categories for earning cashback. Car insurance, home insurance, travel insurance, and other policy types all offer comparison tools with associated rewards for purchases. Because insurance is a high-value product with annual renewals, users can earn considerable amounts simply by comparing quotes through the platform each year. The comparison process remains identical to using standalone comparison sites, with the added benefit of cashback rewards.

Travel and Holiday Deals

Holiday bookings through the platform can generate substantial cashback on already expensive purchases. Hotel reservations, flight bookings, package holidays, car rentals, and travel insurance all qualify for rewards. Major travel booking sites and airline direct bookings participate, giving users flexibility in planning trips. The percentage rates may seem modest, but on expensive travel purchases, even low percentages translate to meaningful cash returns that can offset other trip expenses.

Grocery and Supermarket Cashback

Regular grocery shopping represents an excellent opportunity for consistent earnings. Several major supermarket chains participate, offering cashback on online grocery orders. While percentages are typically modest compared to other categories, the frequency of grocery shopping means these smaller amounts accumulate steadily over time. Some users find grocery cashback alone justifies using the service, as it provides returns on essential purchases they would make regardless.

Refer-a-Friend Program

The platform encourages users to invite others through a referral program that rewards both parties. When existing members refer friends who join and earn their first cashback, both the referrer and new member receive bonus amounts. This incentive structure has helped the platform grow organically as satisfied users share their positive experiences. Referral bonuses can add up quickly for users who successfully introduce multiple friends to the service.

Quidco Premium Membership

Cost and Benefits Breakdown

Premium membership requires an annual subscription fee but eliminates the annual fee that basic members pay on their earned cashback. Premium members receive their full cashback amounts without any deductions, plus gain access to exclusive increased rates at select retailers. Additional benefits include faster customer support response times and early access to special promotional offers. The subscription auto-renews annually unless cancelled, making it a set-it-and-forget-it option for committed users.

Is Premium Worth It? Analysis

Whether Premium membership makes financial sense depends entirely on individual shopping habits and earning levels. Users who earn substantial cashback annually—typically over a certain threshold—save more with Premium than the subscription costs. Casual shoppers who earn modest amounts may find basic membership more economical. The platform provides calculators and estimates to help users determine which option suits their situation. Many users start with basic membership and upgrade once they understand their earning potential.

How to Maximize Premium Membership

Premium members can maximize their subscription value by actively seeking the exclusive increased rates offered to their tier. These special rates often appear on popular retailers during key shopping periods. Additionally, making large purchases like broadband switches, insurance renewals, or major appliances through the platform during Premium membership ensures receiving full cashback without fee deductions. Strategic timing of significant purchases during the Premium subscription period optimizes the value received from the annual fee.

Cancellation Policy

Users can cancel Premium membership at any time through account settings, though subscriptions remain active until the paid period expires. The platform doesn’t prorate refunds for early cancellation, so timing cancellation just before renewal makes most sense for those deciding not to continue. After cancellation, accounts revert to basic membership, allowing continued use of the platform with the standard fee structure. This flexibility lets users try Premium risk-free and make annual decisions about renewal.

Payment and Withdrawal

Minimum Withdrawal Amounts

The platform sets minimum thresholds that users must reach before withdrawing earned cashback. These minimums prevent excessive small transactions that would create administrative burden. The specific amounts vary depending on the chosen payment method, with bank transfers and PayPal having different requirements. Most users accumulate beyond these minimums relatively quickly through regular shopping, making the thresholds reasonable rather than restrictive.

Payment Methods Available

Users can receive their earned cashback through several convenient payment options. Bank transfers deposit funds directly into linked current accounts, typically arriving within a few business days. PayPal transfers offer an alternative for users who prefer that platform or don’t want to link bank details. Some users maintain balances in their accounts rather than immediately withdrawing, allowing earnings to accumulate for larger transfers that feel more substantial.

Processing Times

Once users request a payout, processing times vary by payment method. Bank transfers usually complete within three to five business days, while PayPal transfers may process slightly faster. These timelines account for both the platform’s internal processing and the receiving institution’s processing. During busy periods like post-holiday seasons when many users withdraw accumulated earnings, processing may take slightly longer than usual. Planning withdrawals with these timelines in mind ensures funds arrive when needed.

Fees and Charges

Basic members pay an annual fee deducted from their earned cashback once they accumulate enough to cover it. This fee represents the platform’s revenue from free users. Premium members pay their subscription upfront and face no additional fees or deductions. No fees apply to the actual withdrawal process regardless of membership type or payment method. This transparent fee structure means users know exactly what to expect without hidden charges reducing their earnings.

Tax Implications

For most personal shoppers, cashback earnings don’t trigger tax obligations as they’re considered discounts or rebates on personal purchases rather than income. However, users who operate businesses or earn substantial amounts should consult tax professionals about their specific situations. The platform doesn’t automatically report earnings to tax authorities for personal accounts, but users remain responsible for understanding their individual tax responsibilities. Keeping records of earnings and their source provides documentation if needed for tax purposes.

Tips and Strategies

Maximizing Cashback Earnings

Experienced users employ various strategies to optimize their earnings. Always checking the platform before making any online purchase ensures never missing opportunities. Timing major purchases during special increased rate promotions multiplies returns. Choosing retailers with higher cashback percentages when options exist between comparable merchants adds up over time. Combining cashback with credit card rewards and promotional codes stacks multiple savings layers. Most importantly, treating cashback as a bonus on intended purchases rather than justification for unnecessary spending keeps the practice financially beneficial.

Best Times to Shop

Strategic timing can significantly impact cashback earnings. Many retailers increase their cashback rates during major shopping events like Black Friday, Cyber Monday, and seasonal sales periods. The platform often features special promotions with temporarily boosted percentages. However, users should balance timing considerations with actual need—waiting months for a marginally higher rate on an urgently needed item makes little practical sense. Setting price alerts and monitoring the platform during known sales periods helps capture these enhanced opportunities.

Combining with Credit Card Rewards

Savvy shoppers layer credit card rewards programs on top of cashback earnings for multiple benefits on single purchases. Using cashback credit cards while shopping through the platform means earning both credit card rewards and the cashback percentage. This strategy works because they operate through different mechanisms—credit card rewards come from the payment method while the platform’s rewards come from merchant affiliate commissions. Users essentially get paid twice for the same purchase without any conflicts or violations.

Common Mistakes to Avoid

Several pitfalls can prevent users from earning expected cashback. Failing to disable ad blockers may interfere with tracking cookies, preventing transactions from registering. Adding items to carts before clicking through the platform’s links sometimes causes tracking failures. Using cashback codes from outside sources rather than those displayed on the platform may invalidate affiliate tracking. Returning to the platform after clicking through to a retailer can create new tracking cookies that overwrite the original, causing attribution issues. Understanding these common errors helps users avoid frustration and missing earnings.

Understanding Tracking Issues

Not every purchase tracks perfectly despite users following correct procedures. Browser settings, third-party extensions, or technical glitches occasionally interfere with the tracking process. Retailer policy changes or technical updates on their end may temporarily disrupt reporting. Users shouldn’t panic if cashback doesn’t appear immediately—most transactions eventually track, though sometimes slowly. When legitimate tracking failures occur, the missing cashback claims process provides recourse. Maintaining order confirmations and purchase records facilitates successful claim resolution when necessary.

Quidco vs Competitors

Comparison with TopCashback

The platform’s main competitor offers similar services with subtle differences that may matter to individual users. Both platforms partner with many of the same retailers, though specific cashback rates sometimes differ. One platform might offer better rates on certain categories while the competitor excels in others. Fee structures differ, with each platform taking different approaches to monetization. Some users maintain accounts on both platforms to compare rates before each purchase, ensuring they always receive the highest possible cashback percentage.

Comparison with Other UK Cashback Sites

Beyond the top two platforms, several smaller cashback sites operate in the UK market. These alternatives typically have fewer retailer partnerships and smaller user bases but may occasionally offer competitive rates on specific merchants. Some niche platforms focus on particular shopping categories or demographics. For most users, the leading platforms provide sufficient coverage and reliability without needing to juggle multiple accounts. However, dedicated savings enthusiasts might explore multiple options to maximize every opportunity.

Unique Selling Points

The platform distinguishes itself through several features that competitors don’t fully match. ClickSnap technology for in-store cashback offers unique earning opportunities beyond pure online shopping. The comparison services for utilities and insurance integrate seamlessly with cashback rewards. A user-friendly interface and reliable mobile applications provide smooth experiences. Strong customer service and an established claims process build trust. These differentiators collectively create value beyond simply comparing cashback percentages across platforms.

When to Use Multiple Platforms

Some dedicated users maintain accounts across multiple cashback sites to ensure they always capture the best available rates. This strategy makes most sense for frequent online shoppers who make substantial purchases and have time to comparison shop between platforms. For casual users, the administrative overhead of managing multiple accounts often outweighs the marginal benefits from occasionally better rates elsewhere. The decision comes down to individual shopping frequency, technical comfort, and willingness to invest time in maximizing every penny of savings.

Common Issues and Troubleshooting

Why Cashback Didn’t Track

Tracking failures frustrate users but usually have identifiable causes. Ad blocking software preventing cookies from setting represents one common culprit. Privacy browser extensions that block trackers ironically prevent the tracking needed for cashback attribution. Using browsers in private or incognito modes doesn’t save cookies, breaking the tracking chain. Clicking away from the retailer site and returning through a different path can create new attribution cookies. Following best practices—disabling ad blockers, using regular browser modes, and completing purchases in the same session—prevents most tracking issues.

Resolving Missing Cashback Claims

When cashback legitimately fails to track, the platform provides a systematic claims process. Users access the missing cashback section through their account dashboard and complete a claim form. Essential information includes purchase date, order number, purchase amount, and retailer details. Attaching order confirmation emails or screenshots strengthens claims. The support team investigates by contacting the retailer to verify the transaction. If confirmed, they manually credit the account. Claims filed within specified timeframes have the highest success rates, emphasizing the importance of monitoring pending transactions.

Account Security Concerns

Protecting account security prevents unauthorized access to earned cashback and personal information. Users should choose strong, unique passwords and enable two-factor authentication if available. Regularly monitoring account activity helps identify suspicious transactions quickly. Avoiding public WiFi for account access reduces interception risks. The platform never requests passwords or sensitive information through email, so users should treat such messages as phishing attempts. If security breaches occur, immediately changing passwords and contacting customer support limits potential damage.

Customer Service and Support Options

The platform offers multiple support channels for users needing assistance. A comprehensive help center addresses frequently asked questions and common issues through detailed articles. Email support provides personalized assistance for complex problems, though response times vary. Premium members receive prioritized support with faster response guarantees. Social media channels offer another contact method, sometimes yielding quick responses for simple questions. The community forum allows users to share experiences and solutions, creating peer support networks.

Frequently Asked Questions

Common questions arise repeatedly among both new and experienced users. How long does cashback take to become payable? Why hasn’t a recent purchase appeared yet? Can cashback be combined with discount codes? What happens if an order is partially returned? Does using gift cards affect cashback eligibility? The help center addresses these standard concerns with detailed explanations. Understanding that cashback timing varies by retailer and that patience is often required helps set realistic expectations for new users.

User Experience and Reviews

Customer Satisfaction Ratings

The platform generally receives positive feedback from its extensive user base, with many members expressing satisfaction with the service. Rating aggregators show favorable scores, though experiences vary. Successful users who regularly earn and withdraw cashback tend to rate the service highly. Those encountering tracking issues or claim difficulties sometimes express frustration. Overall sentiment remains positive, with most users acknowledging that while not perfect, the service delivers on its core promise of returning money on purchases.

Trustpilot and Review Analysis

Independent review platforms provide insights into real user experiences. Positive reviews frequently mention the ease of earning cashback, reliable payments, and user-friendly interface. Negative reviews often relate to tracking issues, slow claim resolutions, or customer service concerns. The volume of reviews and average ratings indicate an established service with mostly satisfied users. Reading a range of reviews helps prospective members form realistic expectations about both the benefits and potential frustrations.

Common Complaints and Praises

Recurring praise centers on the tangible savings users achieve through consistent platform use. Members appreciate the straightforward concept, extensive retailer partnerships, and additional earning opportunities through comparison services. Common complaints involve cashback not tracking as expected, lengthy pending periods before earnings become payable, and inconsistent customer support experiences. Some users dislike the annual fee structure for basic members. These patterns emerge consistently across review platforms, suggesting genuine user experiences rather than anomalies.

Real User Success Stories

Many members share stories of substantial earnings accumulated over months or years of regular use. Some users report earning hundreds of pounds annually simply by directing their existing shopping through the platform. Others recount specific windfall cashback from major purchases like new boilers, insurance switches, or broadband contracts. These success stories demonstrate the platform’s potential when used consistently and strategically. They also highlight that meaningful earnings require regular shopping through the platform rather than occasional use.

Pros and Cons

Advantages of Using Quidco

The platform offers numerous benefits for money-conscious shoppers. Earning cashback on purchases users would make anyway provides genuine savings without changing shopping habits. No cost to join and use at the basic level removes barriers to entry. Extensive retailer partnerships mean most shopping needs are covered. Multiple earning opportunities beyond just retail—including utilities, insurance, and travel—maximize potential returns. Mobile apps and browser extensions make the service convenient to use. These advantages collectively create compelling reasons for most UK shoppers to participate.

Limitations and Drawbacks

Despite its benefits, the service has limitations users should understand. Cashback percentages, while helpful, rarely reach levels that dramatically impact overall budgets. Long pending periods mean delayed gratification rather than immediate savings. Tracking doesn’t work perfectly every time, creating occasional frustration. The annual fee for basic members reduces net earnings. Premium membership requires upfront payment that may not suit everyone’s budget. Not every retailer participates, limiting earning opportunities in some shopping categories. Understanding these constraints helps set realistic expectations.

Who Should Use Quidco?

The platform makes most sense for regular online shoppers who can incorporate it into existing habits without significant effort. People planning major purchases like holidays, electronics, or home improvements benefit from cashback on large transactions. Those switching utilities or insurance policies annually can earn substantial amounts through comparison services. Individuals comfortable with technology who won’t find browser extensions and mobile apps burdensome get more value. Basically, anyone shopping online regularly in the UK should consider using the service given the minimal effort required relative to potential returns.

Who Might Not Benefit?

Certain shoppers may find the platform less valuable. Infrequent online shoppers who make few purchases might not accumulate enough cashback to justify even minimal effort. People who strongly prefer in-store shopping miss most earning opportunities despite ClickSnap availability. Those who find tracking requirements and pending periods frustrating might prefer simpler discount codes. Individuals concerned about privacy and cookie tracking may object to the necessary data collection. Shoppers who struggle with technology might find the interface and tools more trouble than they’re worth.

Conclusion

Is Quidco Worth Using?

For most UK shoppers who make regular online purchases, the platform represents a worthwhile addition to their money-saving toolkit. The service requires minimal effort once initial setup is complete, especially with browser extensions handling reminders. While individual cashback amounts seem modest, they accumulate meaningfully over time. The ability to earn on both everyday shopping and major purchases creates consistent value. Given the free entry option, trying the service involves essentially no risk—users can evaluate whether it suits their shopping patterns without financial commitment.

Final Recommendations

New users should start with basic membership to understand their earning potential before committing to Premium. Installing browser extensions immediately maximizes earning opportunities by preventing forgotten cashback. Checking the platform before any significant online purchase becomes a quick habit that pays dividends. Keeping order confirmations for expensive purchases facilitates claims if tracking issues arise. Patience with pending periods prevents frustration—cashback eventually arrives even if not immediately. Treating earned cashback as a pleasant bonus rather than guaranteed income maintains healthy expectations.

Getting the Most Value from the Platform

Maximizing value requires consistent use rather than intensive effort. Making the platform the default starting point for online shopping ensures capturing available cashback. Timing major purchases during special rate increases boosts returns. Exploring the comparison services for annual bill renewals can generate substantial one-time earnings. Combining with other savings strategies like credit card rewards and promotional codes stacks benefits. Referring friends who might appreciate the service adds bonus earnings. These straightforward practices transform casual use into meaningful annual savings.

Future Outlook for Cashback Services

Cashback platforms have demonstrated staying power in the UK market, adapting to changing shopping behaviors and technological advances. Mobile shopping continues growing, and platforms have successfully evolved to capture in-store opportunities. Increasing competition among platforms potentially benefits users through better rates and features. However, retailers might adjust commission structures if acquisition costs become unsustainable. Regulatory changes around data privacy and tracking could affect operational models. Despite uncertainties, the fundamental value proposition—sharing affiliate commissions with consumers—remains sound, suggesting cashback services will continue serving UK shoppers for years ahead.

Also Read: Augusta Precious Metals Lawsuit Separating Facts from Fiction in 2025